The hidden Ribbis trap in your vacation plans

Picture this: you're scrolling through vacation ads when a gleaming "Early Bird Special" catches your eye. Pay now, save later — sounds like a no-brainer, right? But what if I told you this innocent-looking deal might actually involve a Torah prohibition that most of us barely think about?

What exactly is Ribbis?

Ribbis — the Torah's prohibition against charging interest between Jews — sounds like something only bankers need to worry about. Yet this mitzvah weaves through our daily lives in ways that would surprise you. The Torah doesn't just forbid obvious loan shark scenarios; it creates a framework that touches everything from neighborhood favors to vacation bookings.

As Dayan Yehoshua Posen explains in our comprehensive Ribbis course, when you pay that early bird special, you're essentially lending money to the hotel or camp. And when they give you a discount for that advance payment, you're potentially receiving benefit for your "loan" — which raises serious Ribbis concerns.

Why this mitzvah matters more than ever

Our ancestors didn't deal with credit cards, mortgages, or pension funds. Today's financial world creates Ribbis situations that previous generations never imagined. That gym membership with a discount for paying annually? The friend who offers you a better deal if you pay upfront for something? These everyday scenarios often involve the very prohibition our ancestors took so seriously.

The deeper wisdom here reflects a profound Torah truth: money isn't just numbers on a bank statement. It's a tool for building relationships based on genuine help, not exploitation. When we charge each other interest, we turn acts of kindness into business transactions.

Beyond money: the surprising reach of Ribbis

Here's where it gets really interesting — Ribbis doesn't just apply to cash. Lend your neighbor a cup of sugar, and if they return a cup of premium sugar, that extra quality might constitute Ribbis. Help someone move their furniture, and if they insist on paying for your gas plus extra for your time, you've entered Ribbis territory.

This isn't about being nitpicky; it's about recognizing how the Torah creates a society where help flows freely without hidden price tags. When we understand these laws, we can navigate modern life while preserving the Torah's vision of genuine community support.

Practical steps for Ribbis awareness

Start with a Ribbis audit: Look at your recurring payments. Which ones involve paying in advance for a discount? These need halachic review.

Create a reference system: Keep contact information for a Rav who can answer Ribbis questions. Financial decisions happen fast, and you'll want quick access to guidance.

Educate your circle: Share this awareness with family and friends. Most Ribbis violations happen through ignorance, not intention.

Develop Ribbis sensitivity: Before any financial transaction involving advance payment or delayed settlement, pause and ask: "Could this create a Ribbis issue?"

Building a Ribbis-conscious community

When we take Ribbis seriously, something beautiful happens. Our financial interactions become opportunities for genuine chessed rather than subtle exploitation. Instead of early bird specials that might violate Torah law, businesses find creative ways to reward loyalty without creating interest-like benefits.

This creates communities where people help each other freely, knowing that nobody's keeping hidden score sheets or expecting financial returns on every kindness.

Understanding Ribbis transforms how we see money, relationships, and community. What seemed like a distant banking law becomes a roadmap for building the kind of society the Torah envisions — one where genuine help flows freely.

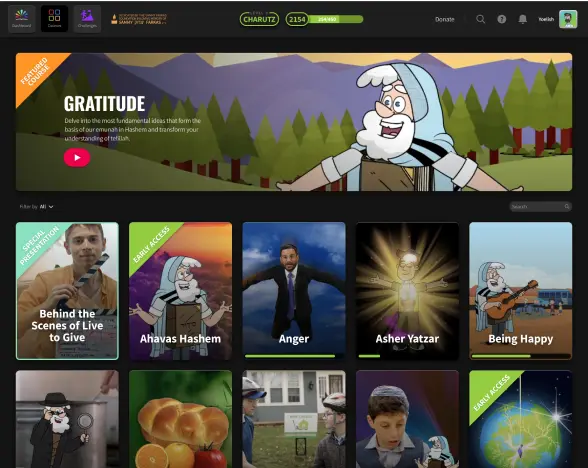

Ready to dive deeper into this fascinating area of Halacha? Torah Live's Ribbis course breaks down complex concepts into engaging, practical lessons your whole family can understand. Sign up free and discover how Torah wisdom applies to every corner of modern life!